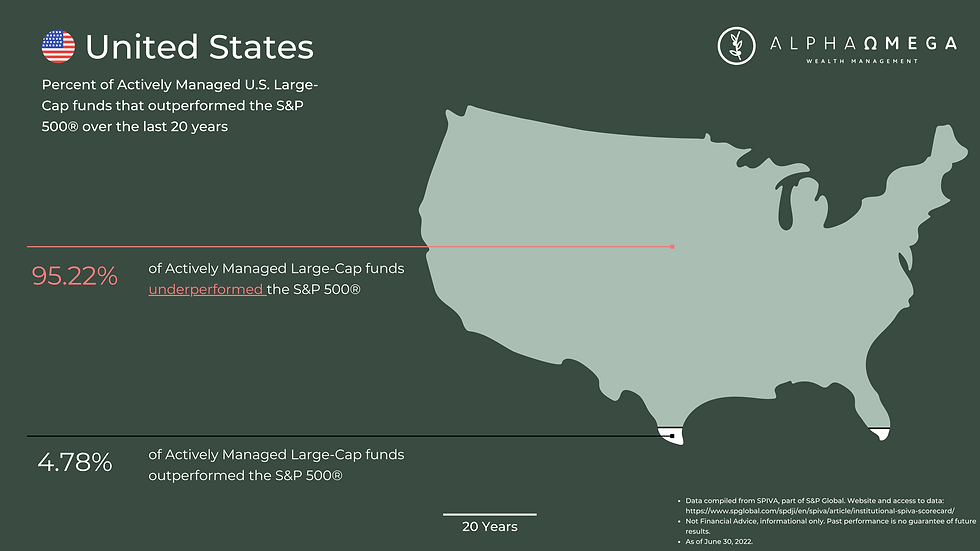

Look at this chart:

IMPORTANT DEFINITIONS:

Actively Managed Funds: A fund manager actively decides which stocks should be in the fund to beat a benchmark.

Passively Managed Funds: These funds typically track an index that sets some basic parameters but doesn't include/exclude certain stocks in hopes of beating a benchmark. The S&P 500® is a common passive index.

If your advisor has you in actively managed funds, keep reading.

BIRTHDAY DINNER

I was at dinner for a friend's birthday a few years ago. One of the guests at our table worked as a stockbroker for a well-known national stockbroker.

We got on the topic of active vs. passively managed funds. He criticized clients who would request switching out of active funds and into passive ones (which are much cheaper than actively managed funds). His justification: "You get what you pay for. These active funds are expensive because you receive a better return."

Because I'm a great dinner guest, I didn't say what I should have: "You must not read the research – because you're beyond incorrect."

The data has been out for some time. In the long run, almost no one can beat the stock market. And the few that do beat it can only credit blind luck.

Catch this:

Over the last 20 years, only 4.78% of actively managed Large-Cap Funds outperformed the S&P 500®.¹

WHY DOES YOUR FINANCIAL ADVISOR PUT YOU IN THESE FUNDS?

Simple – fat commissions. Your advisor is likely getting paid a commission by these funds. A portion of those excessive fund fees, which come at your expense, is "kicked back" to the advisor.

The kickback is often ON TOP of an asset management fee your advisor charges you.

This is called a conflict of interest. The advisor may invest your money in something that is not the BEST thing for you because they receive a larger commission in that fund instead of a fund that is best for you…..but pays a smaller commission.

Many advisors won’t put you in a passive fund, which have shown historically to have better returns, because actively managed funds give them a better commission. This is why MOST advisors hate the chart above.

WHAT'S THE ALTERNATIVE?

Find an advisor who is "fee-only," not to be confused with "fee-based." See below:

"Fee-Based" advisors receive a commission in addition to other types of fees they may charge.

"Fee-Only" advisors do not receive any commissions. They charge either a % of assets under management, a flat fee, or a combination of both. The biggest thing: no commissions.

Here at AlphaOmega Wealth Management, we do what is absolutely best for the client by reducing conflicts of interest, like commissions.

We're not afraid of that chart as we also invest our clients in passive funds - if you can't beat 'em (no one can), join 'em.

Subscribe to receive more articles like this, or get in contact with us:

__________________________________________________________________________________

Risk Disclosure: Investing involves risk, including the potential loss of principal. No investment strategy can guarantee a profit or protect against loss in periods of declining values. Past performance does not guarantee future results.

This material is for information purposes only and is not intended as an offer or solicitation with respect to the purchase or sale of any security. The content is developed from sources believed to be providing accurate information; no warranty, expressed or implied, is made regarding the accuracy, adequacy, completeness, legality, reliability, or usefulness of any information. Consult your financial professional before making any investment decision. For illustrative use only.

Comments